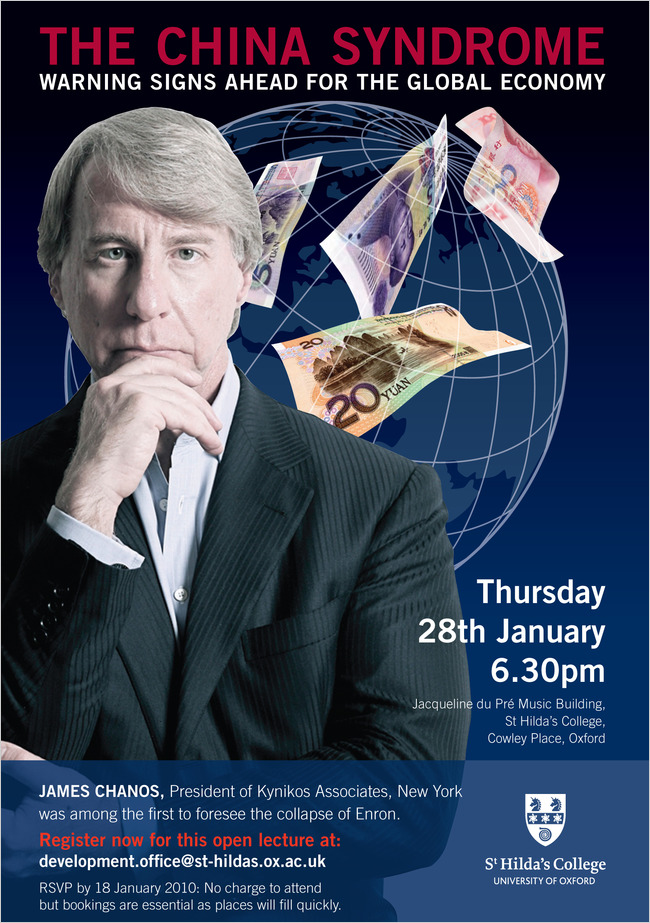

Jim Chanos is ultra bearish on China. In fact he is taking the rare step of “talking up his book” in a speech at Oxford.

Chanos is a pretty smart investor who has had many big well-publicized wins betting against frauds like Enron, and others. But like some other brilliant investors i.e. Lawrence Tisch, and Julian Robertson he can be very stubborn in shorting “bubbles”. The latter two, lost billions betting against US stocks during the tech bubble of the 90’s. Of course they were eventually “proven right”. Good for the ego, not the wallet.

Sure China is a manipulated market, with government warehouses stuffed with unsold goods. BUT…now may not be the best time to be betting against a government wth trillions in reserves. Chanos may be right on fundamentals, but his timing is off.

When is the time to short China? Right after Jim Chanos is humiliated by billions in losses, and closes up shop.

China-and commodity stocks may be headed towards one final blow-off top. Don’t short this one – yet.

Story