“Unofficial” news update on (CSE: NEWS) (OTC: REGRF).

From Jack Marks, CEO dialMKT Corp., (CSE: NEWS major shareholder)

The letter below is a personal opinion, and not in any way any form of official statement, or “revenue guidance” by $NEWS.

Dear shareholders,

I want to give you an update on the latest development at $NEWS. I am speaking only as CEO of dialMKT Corp (which is majority owned by $NEWS, and in which I am a major shareholder).

As you know, (CSE: NEWS) trading was suspended in November by the CSE.

We believe the CSE’s underlying claims for the the trading halt and suspension are totally without basis and are in fact brazenly FRAUDULENT.

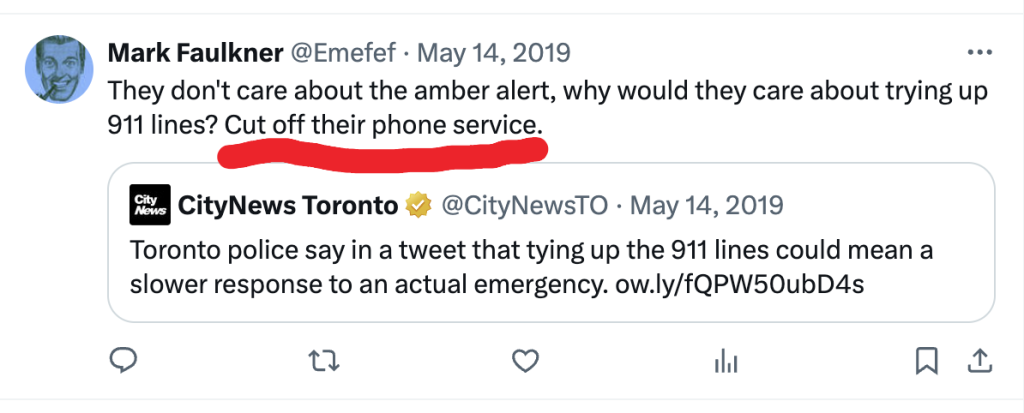

What has become clear is the CSE’s “regulator” Mark Faulkner is a CORRUPT bureaucrat pursuing his personal vendetta against Jack Marks – at the expense of thousands of $NEWS shareholders.

A growing stack of evidence now proves that Mark Faulkner maliciously fabricated a baseless and FRAUDULENT case to remove Jack Marks as Chairman of $NEWS, and halt trading in the stock. The crooked Mark Faulkner then reneged on an agreement, and suspended trading in $NEWS stock, causing millions of dollars in losses of Canadian investors.

But first – “the good news”….

When I came in as chairman of $NEWS in September, I shared with you my personal goal of creating and maximizing shareholder value through organic growth and M&A

Before I came in as Chairman of $NEWS, the stock was trading at C$0.01 with barely any volume, and it was a dead company.

From the day the dialMKT/$NEWS transaction was announced the stock increased +300% from $0.01 to $0.04 with millions of shares trading. $NEWS was in the TOP 3 highest volume stocks on the CSE for many days in a row.

This increase in shareholder value was achieved with minimal resources, and despite not having a full OTC listing, leaving out 95% of US market buyers.

I am not shy in stating that my personal goal is to create +100X upside in the stock. (This is not investment advice, or “price representation” – just my personal goal).

In presentations, I shared with you the path for how this +100X upside can potentially be achieved for $NEWS via organic growth and strategic M&A.

I have publicly stated over the years, and in my book TEN BAGGER BLUEPRINT, that +100X should be the goal of every public company CEO. And making $NEWS a +100X stock was my personal goal from day one.

While a potential +100X increase in $NEWS from $0.01 to $1.00 may sound aggressive, it’s actually an achievable process. All that is needed to achieve this is $10-20 million in revenue run-rate and a 10X revenue multiple (which is reasonable based on comps).

In a presentation a few months ago, I shared with you that dialMKT/$NEWS was in various stages of talks with e-commerce companies in the watch market. These potential M&A targets have revenues ranging from $5 million to $100 million. While there is no guarantee that any transaction will happen, we’ve developed a creative financing structure that could make a deal happen, on an accretive basis, maximizing value for $NEWS shareholders.

At the same time, dialMKT is growing organically, and based on on our market traction, and revenue pipeline, we believe dialMKT can hit a $2-3 million run rate by end of 2025, and achieve $7-10 million run rate in 2026. The market usually rewards that type of revenue velocity with a 10X multiple, which means $NEWS could be valued at US$70-100 million based on full ownership of dialMKT. That represents a +50X upside potential from current stock price.

In November, I told you that dialMKT was entering an “inflection point” with the start of e-commerce. That is exactly what happened.

dialMKT achieved it’s first meaningful month of e-commerce REVENUES in December, hitting a 6-figure run rate.

The gross revenues of that first month, exceed ALL of (parent company) $NEWS revenues for 2024 by a significant margin. Revenues continue to increase.

This is as a result of our e-commerce online auctions via partnerships with platforms LiveAuctioneers.com and bidsquare.com. We are adding more platform partnerships to expand our audience further.

February’s e-commerce revenues was more than DOUBLE revenues of December.

In fact, dialMKT revenue for February alone was +400% greater that ALL of $NEWS revenue in full year of 2024.

dialMKT revenue pipeline continues to INCREASE.

The media side of dialMKT has also delivered growing metrics across all KPI’s including advertising.

Most importantly, dialMKT’s recent high-end watch sales, validate our thesis of 3C synergies: content-commerce-community.

In December, we expanded dialMKT’s e-commerce into the fine art secondary market category which has major synergies with the luxury watch resale market. This is validated by the cross-category model being embraced by Sotheby’s Christies Phillips.

The “secondary art market” is generally defined as the re-sale market for works by artist that have established auction records, and represents the bulk of the $65 billion global art market (source: UBS bank). dialMKT’s focus is in the “lower/middle market” which is works that sell for $10K-$500K at auction. Most importantly, the secondary art market is an area in which our team has deep domain expertise, with a track record of record-breaking and milestone setting sales, and buy/sell-side relationships. dialMKT has already made a number of high-margin sales in this category in the first few months.

It is my opinion (based decades of successful experience in micro-caps) that $NEWS would be trading at trading at $0.07-.10 today based on the milestones achieved on past few months, and the growing revenue pipeline.

Unfortunately for the 4,000+ shareholders of $NEWS the stock was unlawfully and MALICIOUSLY halted/suspended by the CSE.

We believe the CSE’s underlying claims for the the trading halt are totally without basis and are in fact FRAUDULENT.

What is really disturbing is evidence of BRAZEN FRAUD, CORRUPTION and ABUSE OF POWER perpetrated by the CSE’s chief regulator Mark Faulkner and co-conspirators to pursue a personal vendetta, which forms the entire basis of the trading suspension.

It gets worse. The CSE’s Crooked Mark Faulkner is also demanding that $NEWS “UNWIND” the dialMKT transaction.

What that means for shareholders is: $NEWS stock will COLLAPSE to ZERO and investors will lose EVERYTHING – if crooked Mark Faulkner is not stopped.

Unwinding the transaction would mean that $NEWS would LOSE the only real revenue generating asset, and sole driver of shareholder value.

The stated mandate of CSE’s regulator is “INVESTOR PROTECTION”. This is clearly a cheap farce as demonstrated by Mark Faulkner’s and his co-conspirators malicious actions that have harmed $NEWS shareholders and will cause them to lose all their investment.

The CSE’s actions set a DANGEROUS PRECEDENT which will harm the integrity of Canadian capital markets.

No sane company should want to list their shares on the CSE knowing there is a possibility their stock could be halted because of a corrupt regulator like Mark Faulkner and his co-conspirators.

No sane investor should risk buying CSE listed stocks because trading could be suspended and their shares made worthless because of a corrupt regulator like Mark Faulkner and his co-conspirators.

There is an ongoing legal proceeding and we can’t reveal the full details until the process is complete. Once the Hearing is over, we will be posting ALL files, and documents online. You will be able to see with your own eyes, the level of CORRPUTION and FRAUD perpetrated by Mark Faulkner and his co-conspirators. This evidence will clearly show that CSE’s Mark Faulkner and his co-conspirators committed a brazen FRAUD – causing MILLIONS OF DOLLARS IN LOSSES FOR INVESTORS.

We are in the midst of the CSE hearing process now. Whatever the outcome of the hearing, we will file class-action lawsuits against the CSE to collect damages. The CSE’s Directors could also be held personally liable for financial damages for their oversight failure, and complicit role in defrauding investors through abuse of process. We will also work to have Mark Faulkner and his co-conspirators face criminal prosecution for conspiracy to commit fraud amongst other charges, and brought to justice in US Federal Courts.

The CSE’s Corrupt Regulator Mark Faulkner

(Above photo with slob Mark Faulkner at right)

Mark Faulkner is deeply compromised with multiple conflicts of interests underlying his role in this matter. This includes Faulkner’s relationships with fraudulent stock promoters and other cronies. Faulkner’s abuse of power is at the expense of $NEWS 4,000 shareholders who are “collateral damage” in Faulkner’s corrupt quest to curry favors with his fraudster cronies.

A Hearing at the CSE was schedule for January 15, 2025 to resolve the matter, leading to the return of $NEWS to trading. In a recurring pattern of ABUSE OF PROCESS, and BAD FAITH, Faulkner and CSE have refused to provide any evidence and documents demanded by our legal counsel necessary for the Hearing. Mark Faulkner and his co-conspirators brazenly LIED about multiple aspects of the case including critical documents and emails they claimed did not exist, but which have “miraculously” been discovered..

After months of delays, brazen lies, excuses and abuse of process, by Mark Faulkner and the CSE – only a few of the requested documents were turned over. The documents and “evidence” produced by Faulkner were discovered to be sloppily fabricated – and evidence of an EGREGIOUS FRAUD by Mark Faulkner and his co-conspirators leading to the trading halt in $NEWS.

When caught in their brazen fraud, the CSE adjourned the 1/15 hearing at the very last minute – without consulting our attorneys – and brought in outside law firm, Norton Rose, to represent the CSE at the Hearing. Hiring outside counsel, was a clear attempt to COVER UP Faulkner’s and his co-conspirators sloppy fraud.

A new Hearing was tentatively scheduled for early April. This again has been pushed back AGAIN – because the CSE produced yet more problematic documents which appear to be FABRICATED and FRAUDULENT.

Initial forensic analysis of an internal memo that Faulkner claims was written on January 8 2024 – was in fact fabricated in recent weeks. Further, the analysis indicates the memo was NOT written by Faulkner – but appears to be concocted by the shyster lawyer they hired to cover up their crime: Norton Rose’ sassy little shyster Andrew McCoomb.

(Norton Rose’ sassy little shyster Andrew McCoomb)

These new documents including e-mails (which Faulkner denied having) further expose the clear conflicts of interest of CSE officials Mark Faulkner and Rob Cook in this case, and point to their possible corrupt motivations.

At this point, it appears the CSE’s strategy is to bury $NEWS – (until shareholders forget about their investment), through attrition, ongoing delays and abuse of process.

There is an ongoing legal proceeding and we can’t reveal the full details until the process is complete. Once the Hearing is over, we will be posting ALL files, and documents online. This evidence will clearly show that CSE’s Mark Faulkner and his co-conspirators committed a brazen FRAUD – causing MILLIONS OF DOLLARS IN LOSSES FOR INVESTORS.

We are in the midst of the CSE hearing process now. Whatever the outcome of the hearing, we will file class-action lawsuits against the CSE to collect damages. The CSE’s Directors could also be held personally liable for financial damages for their oversight failure, and complicit role in defrauding investors through abuse of process. We will also work to have Mark Faulkner and his co-conspirators face criminal prosecution for conspiracy to commit fraud amongst other charges, and brought to justice in US Federal Courts.

Canadian Securities Exchange: Corruption? Incompetence? Or Both?

It should be noted the CSE had more than FIVE WEEKS weeks to review the dialMKT/$NEWS transaction before the deal was announced in September. The CSE and $NEWS attorneys went back and forth over various issues normally raised, before the CSE allowed the transaction to be move ahead.

This FIVE WEEK period was more than enough time to address any “issues” the CSE would have.

After the transaction was announced in September, the CSE and Canadian regulators had an additional week to make any comments before the deal officially closed. During this time there were ZERO comments, and the transaction was permitted to close.

It was only weeks later – AFTER the $NEWS increased over +300% with millions of shares traded, that Mark Faulkner decided to fabricate a baseless, and concocted case to halt trading.

Is this a result of the CSE’s INCOMPETENCE? Corruption? Or both?

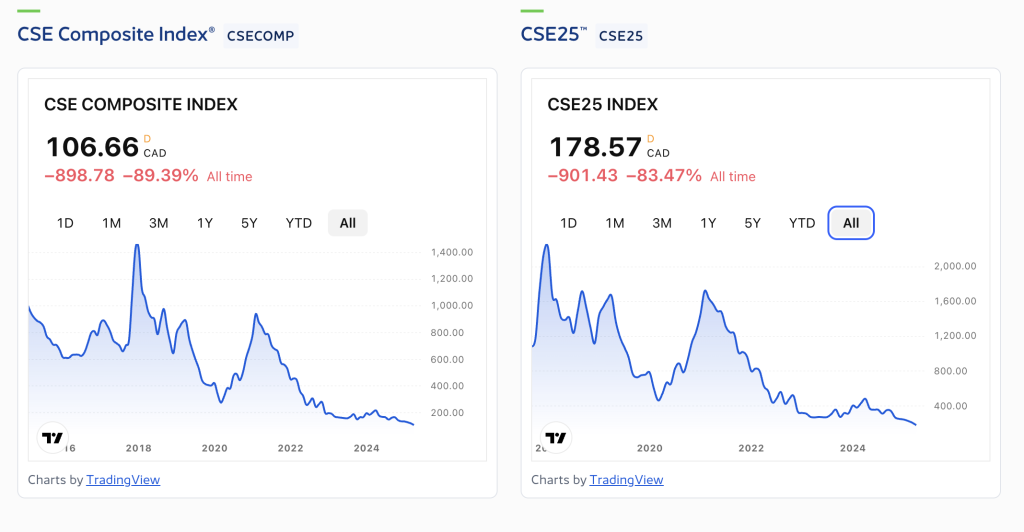

Canadian investors already know of the bad reputation of the CSE as “an Exchange of Scams”, which has collapsed -87% over the past 5 years, (on Mark Faulkner’s watch) destroying billions of dollars of investors savings.

This makes the CSE one of WORST PERFORMING STOCK MARKETS OF ALL TIME.

Look at these charts!

Can the CSE’s reputation get any WORSE?

The CSE’s Mark Faulkner and Rob Cook’s corrupt actions and abuse of power demonstrate the CSE is no longer a free marketplace. Rather, it is toxic mix of CLASSICAL FACISM / kleptocracy like Putin’s Russia – where a corrupt crony class actively managing outcomes and deciding who it will choose to win or lose.

The CSE and its board of directors are recklessly ignoring the second-order effects of having out-of-control, unsuitable regulators.

The damage to the CSE and Canadian capital markets may not be immediate, but the damage will come home to roost. The CSE’s -87% loss over the past 5 years, causing billions in losses to investors is a hint of what’s to come.

The CSE and Faulkner’s corrupt actions will have a long-term chilling effect on Canadian capital markets and entrepreneurs. The price will be increased costs of capital as risk rises. One of the reasons CSE stocks are notoriously volatile is that investors sell shares at any possible rumor of a stock being halted/suspended.This will only get worse and the “risk premium” will rise.

The CSE has been in a DOWNWARD SPIRAL as its listings are shrinking every day. The CSE is filled with countless “zombie stocks” which are suspended and getting delisted. New listings are shrinking. Unless the CSE’s board of directors takes immediate action, the CSE is doomed to failure in the near future. This doom spiral is exacerbated by Mark Faulkner’s corrupt actions as seen with $NEWS.

Mark Faulkner is a cancerous threat to Canada’s investors and market integrity and makes a mockery of the rule of law.

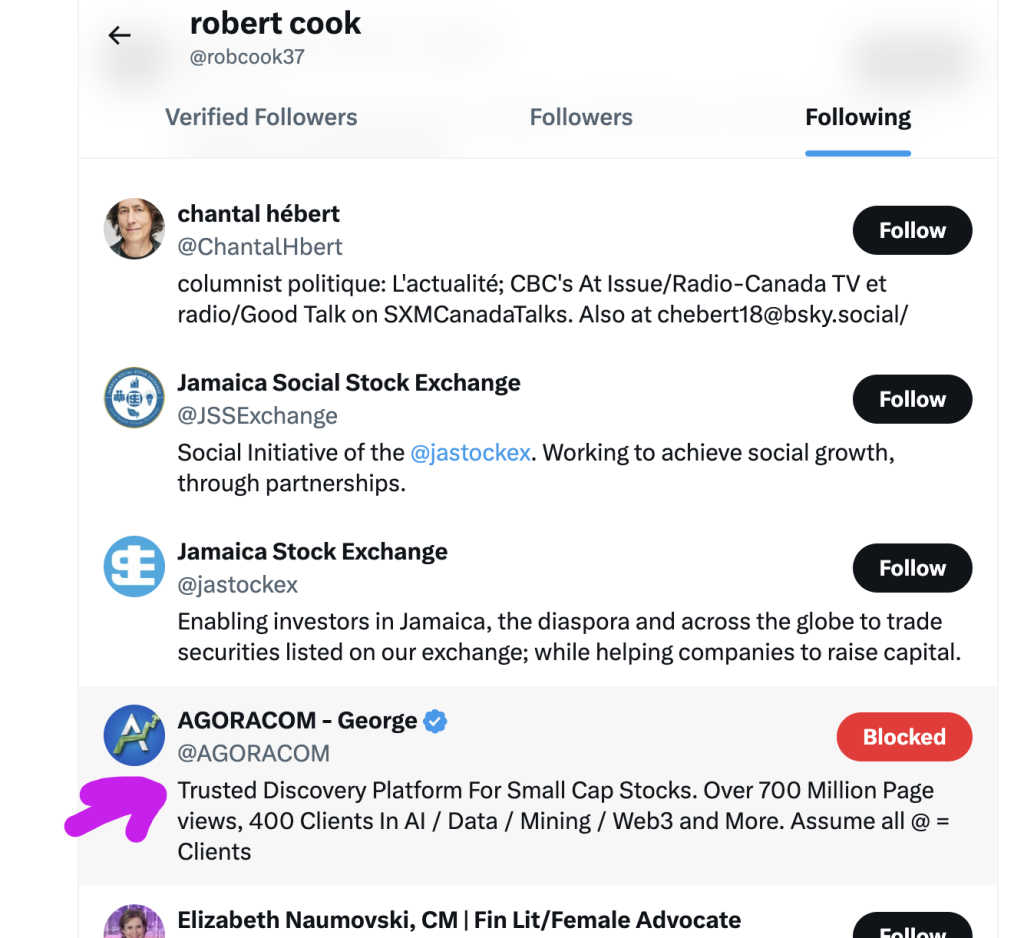

The evidence shows that Mark Faulkner and Rob Cook have a crony network of favored and protected stock promoters, including those with a history of massive fraud such as George Tsiolis of Agoracom which calls into question Faulkner’s credibility and motivations.

What is the MOTIVATION of Mark Faulkner and Rob Cook and co-conspirators?

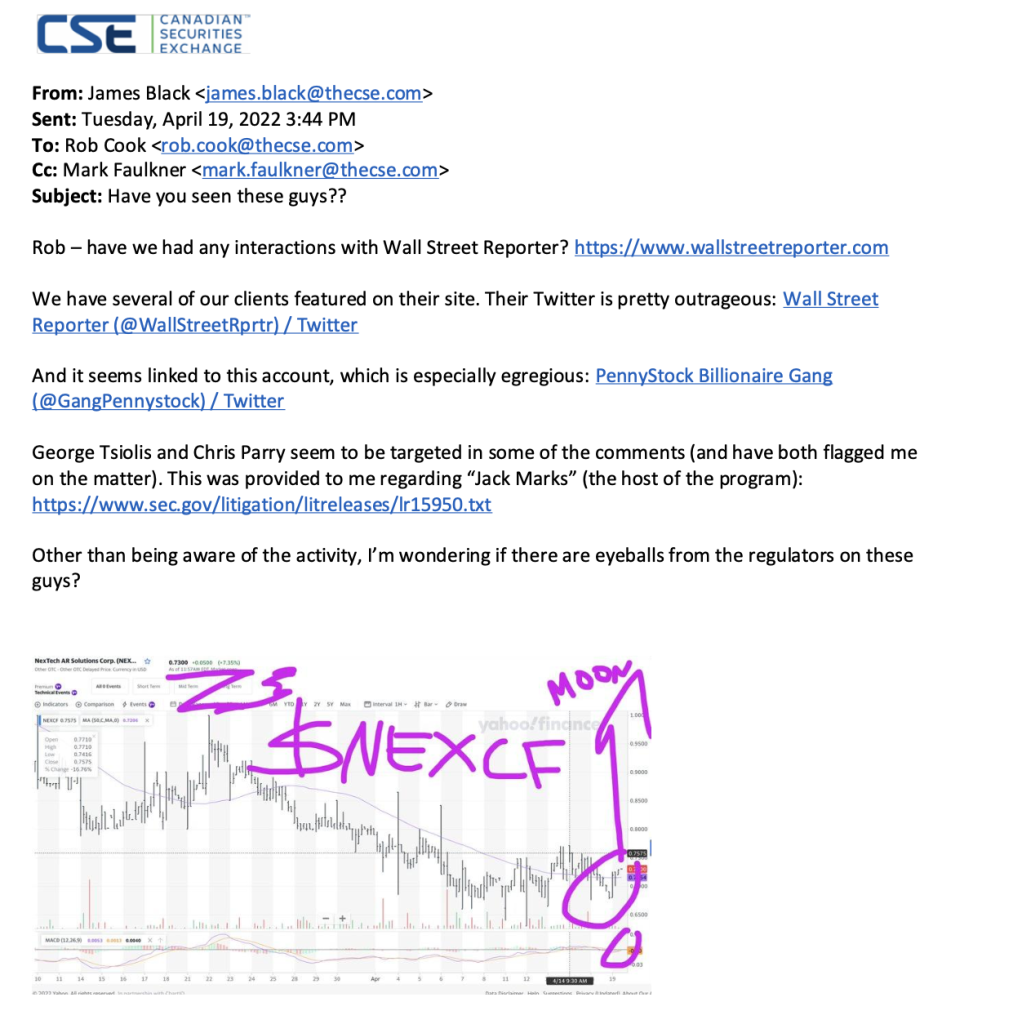

The CSE was forced to finally produce internal documents (which they LIED about having) which exposed Mark Faulkner and his co-conspirators at the CSE are in bed with sleazy stock promoters such as vile anti-semite Chris Parry, and fraudster George Tsiolis.

The CSE was forced to produce a June 2022 e-mail showing that George Tsiolis and Chris Parry, fueled by professional jealousy, filed a baseless and false complaint, with their friends at the CSE, Mark Faulkner And Rob Cook to “look into” Jack Marks. The purpose of this false compliant was to disrupt the business of Jack Marks / Wall Street Reporter with a regulatory Witch Hunt, and to damage and discredit his reputation and that of Wall Street Reporter.

Jack Marks and Wall Street Reporter has been responsible for creating billions of dollars in shareholder value for investors, helping countless CSE-listed issuers build market support, with many of these stocks increasing +500%-+1,000% and more during the time they engage Wall Street Reporter.

CSE-listed clients of Wall Street Reporter were able to raise over $300 million (creating hundreds of jobs in Canada) as a direct result of Jack Marks and Wall Street Reporter services in a 3 year period.

The question is why are CSE regulators such as Mark Faulkner and Rob Cook and associate James Black friends with a notorious fraudster George Tsiolis?

(Exhibit B8 – Internal email Faulkner and CSE DENIED existed – which clearly proves Faulkner and Rob Cook prejudice)

George Tsiolis of Agoracom was busted by the Ontario Securities Commission for creating 670 fake accounts on his message boards to pump stocks and rip off investors. Tsilois was fined $150,000, banned from the investment industry, and his law license has apparently been revoked as well.

According to a news article from CBC:

“Ontario’s securities regulator Friday imposed fines and penalties on two directors of Agoracom, a Toronto firm that runs a website that does investor relations for companies listed on the Toronto Stock Exchange and TSX Venture Exchange.

Agoracom founder George Tsiolis and dealer Apostolis (Paul) Kondakos acknowledged they required Agoracom staff to use hundreds of fake names and to pose as investors in thousands of messages on the firm’s public online forums.

Kondakos, the firm’s chief officer responsible for compliance with securities regulations, also intercepted private messages between public users of the forum from July 2008 to February 2009 to gather information about companies in which he was invested.

The Ontario Securities Commission ordered Tsiolis and Kondakos to pay $125,000 to a fund administered by the commission and $25,000 toward the costs of its investigation. It also banned them from working as investment professionals for 10 years and from trading or investing in any client of Agoracom’s. The two are also permanently prohibited from being a director or officer of any client of Agoracom or its affiliates and from being a director of any public company for five years.”

Our investigators have also uncovered a number of Mark Faulkner other deeply disturbing relationships, which we will be reporting on soon.

Mark Faulkner and Rob Cook have a corrupt relationship with Tsiolis and Parry. This corrupt and inappropriate relationship with these promoters (including FRAUDSTER George Tsiolis), naturally PREJUDICED them in any action regarding their business competitor Jack Marks.

Yet, Mark Faulkner and Rob Cook involved themselves in the CSE Decision underlying the trading halt, and did not recuse themselves, in a clear cut case of JUDICIAL BIAS and ABUSE OF PROCESS.

(Exhibit B-2: Mark Faulkner and Rob Cook personal twitter account following Chris Parry and George Tsiolis. Notably, Faulkner and Cook do not follow any other promoters, indicating a special relationship)

(Corrupt CSE executive Rob Cook, friend of Fraudster George Tsiolis)

What is becoming apparent is the infamous “Canadian Crony Capitalist” system at work. The “old boys club” determined to keep out outsiders at all costs.

Mark Faulkner: UNSUITABLE to be a stock exchange regulator.

(Sleazebag Mark Faulkner)

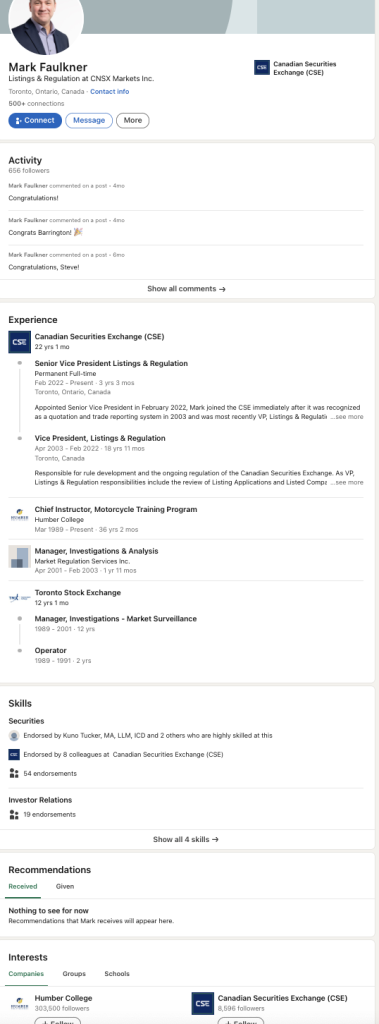

What is most shocking about this entire case is how the CSE and it’s Board of Directors would allow a comically unqualified individual like Mark Faulkner into a position as regulator and give him unchecked powers.

Mark Faulkner has ZERO relevant educational or career background that would qualify him to be the regulator of a stock exchange like the CSE.

You would think that a stock exchange regulator would have a law degree, and or and MBA, CFA and experience capital markets. That is the case with all US financial markets and most stock exchanges worldwide.

According to Mark Faulkner linkedin profile:

– Mark Faulkner has ZERO legal education or background.

- Faulkner has ZERO investment education or background.

- In fact Faulkner never even passed the Canadian equivalent of a Series 7 stockbrokers exam.

Faulkner’s most extensive work experience is as a motorcycle riding instructor (lol).

“Chief Instructor, Motorcycle Training Program at Humber College

Mar 1989 – Present · 36 yrs 2 mos”

After graduating Humber College (is this even a real school?), Faulkner worked at the Toronto Stock Exchange as a glorified trading clerk, eventually brown-nosing his way up in bureaucratic positions.

Somehow he was hired as regulator at the CSE when it launched in 2004, by his network of TSX cronies who all migrated to the CSE.

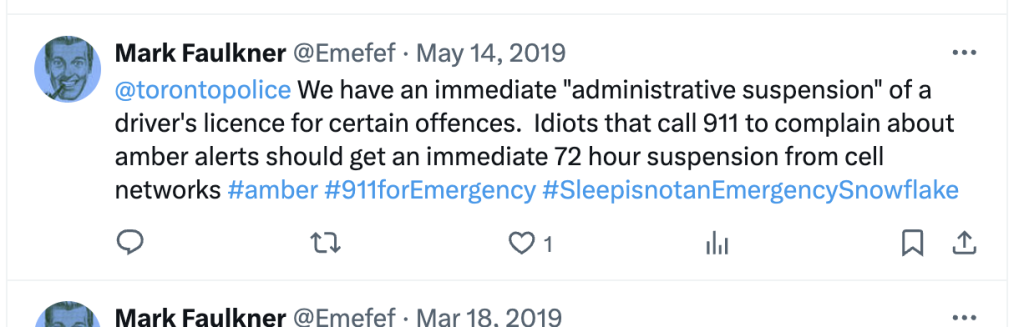

Faulkner’s personal twitter account is filled with lunatic self-righteous rants, “Mall Cop Energy”, anti-American sentiments, and connections to sleazy stock promoters such as his crony rabid anti-semite Chris Parry.

(Exhibit C-13: Faulkner mall-cop energy and insane rantings on twitter)

Faulkner’s twitter account also promotes a number of CSE pump & dumps issuers on his account. (Almost all of which have become worthless.).

(Exhibit: C14: Faulkner promoting stocks on his twitter account)

Screenshot 2025-01-08 at 6.04.18 PM

The question is: why is an exchange “regulator” promoting stocks and befriending sleazy stock promoters?

Any regulatory professional would know to at least show a sense of impartiality. But not Faulkner.

The CSE board of directors has willfully disregarded their oversight duties in allowing an UNQUALIFIED and UNSUITABLE individual such as Mark Faulkner to be in a position as regulator.

The results of Mark Faulkner reign as the incompetent and unsuitable regulator of the CSE are clear: an -87% COLLAPSE in the CSE index over the past 5 years. This makes the CSE the WORST stock market performance in modern history.

Under Mark Faulkner’s watch, Canadian investors lost LOST BILLIONS OF DOLLARS due to an influx of low-quality companies listing on the CSE. This includes hundreds of sketchy drug dealers (a.k.a fugazy cannabis and psychedelics stocks) and various “Shitcos”. Notably, Mark Faulkner was cheerleading and promoting these stocks on his personal twitter account.

Mark Faulkner does not have the education, intelligence, or experience necessary to make qualitative analysis and decisions necessary in a regulatory capacity. Our e-mail interactions with Mark Faulkner reveal him to be shockingly stupid/and or corrupt. (These emails will be published online after the hearing).

Faulkner’s co-conspirator Rob Theriault is almost as laughably unqualified. Rob Theriault, whose title is “Director, Listings & Regulation” spent a decade at various jobs as a cold calling salesman, pitching credit card processing, mortgages, and office supplies. His only stock market related experience was 5 *months* working at Edward Jones as a cold caller.

Shockingly, with no relevant financial or legal background, Rob Theriault was then hired as “Manager Listings and Regulation”. Apparently, his job is to pitch companies to list on the CSE and then to regulate them.

Clearly the CSE ignores the obvious conflicts of interest: a salesman bringing in new listings and then “enforcing regulations”. But this is the least of the CSE ethical dilemma’s.

Mark Faulkner is Destroying the CSE’s (already bad) Reputation

The CSE’s Mark Faulkner and Rob Cook’s corrupt actions and abuse of power demonstrate the CSE is no longer a free marketplace. Rather, it is toxic mix of CLASSICAL FACISM / kleptocracy like Putin’s Russia – where a corrupt crony class actively managing outcomes and deciding who it will choose to win or lose.

The CSE and Faulkner’s corrupt actions will have a long-term chilling effect on Canadian capital markets and entrepreneurs. The price will be increased costs of capital as risk rises. One of the reasons CSE stocks are notoriously volatile is that investors sell shares at any possible rumor of a stock being halted/suspended.This will only get worse and the “risk premium” will rise.

The damage to the CSE and Canadian capital markets may not be immediate, but the damage will come home to roost. The CSE’s -87% loss over the past 5 years (on Faulkner’s watch), causing billions in losses to investors is a hint of what’s to come.

Mark Faulkner is a cancerous threat to Canada’s investors and market integrity and makes a mockery of the rule of law.

Is the CSE racist?

It is interesting that the CSE’s website is filled with pandering “woke” marketing drivel including the following hilarious language:

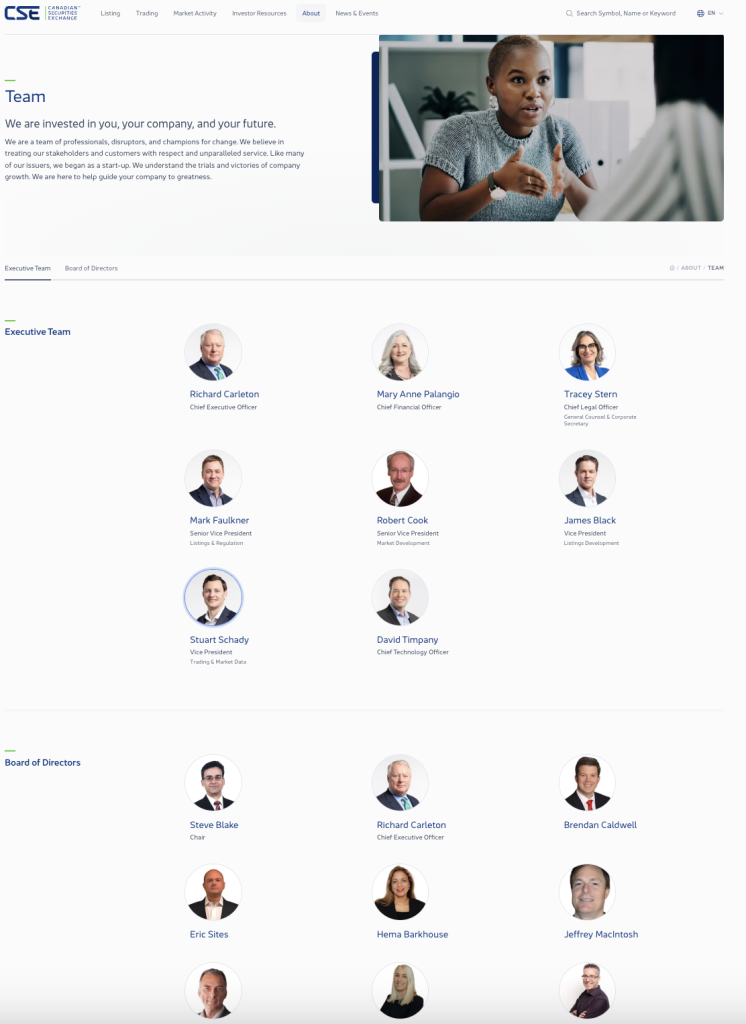

The CSE’s website https://thecse.com/about/team/#executive-team

“We are invested in you, your company, and your future.

We are a team of professionals, disruptors, and champions for change. We believe in treating our stakeholders and customers with respect and unparalleled service. Like many of our issuers, we began as a start-up. We understand the trials and victories of company growth. We are here to help guide your company to greatness.”

“The CSE believes in nurturing an inclusive community of employees. A workforce that reflects the diversity of the community in which it operates. We encourage all members of our community to apply. You just need to be the best person for the position to become a part of our team.”

What is most HILARIOUS is the CSE uses a stock photo image of a black woman with a shaved head on their “Team” page. This “black-washing” is clearly to gaslight you into thinking the CSE is “diverse” and “inclusive” – when the reality is the exact opposite.

Using a black female “mascot” as the representative of the all-white CSE team is just another link in what appears to be a pattern of misrepresentation and FRAUD.

The CSE claimed to be “an inclusive community of employees. A workforce that reflects the diversity of the community in which it operates.” Yet, a look at all the photos on their site shows that 99% of CSE executives and Directors are white Anglo-Saxons. This is quite unusual in a city such as Toronto which is 55% minority.

Based on our experience working with numerous Canadian public companies, at least 50% of CEO’s and capital markets are Asian/Indian/Middle-Eastern. Looking at the shareholder list of $NEWS, more than 80% of the shareholders appear to be minorities/immigrants. Probably 50% of Canadian public companies have similar shareholder demographics.

We’re sure it’s “just a coincidence” that the CSE executives are 99% white, and they are not discriminating against the minorities who actually drive most of Canada’s economy and capital markets.

Is the CSE the financial outpost of Canada’s infamous INSTITUTIONAL RACISM?

Is an element of racism, bias, and double standards, involved in how the CSE chooses to target certain companies, and individuals?

Mark Faulkner and his con-conspirators at the CSE have demonstrated a clear pattern of fraud in this case and will be referred to US Attorney General for prosecution under RICO and Enterprise Corruption statutes.

The CSE’s anti-competitive actions targeting US businesses will also be of interest to Howard Lutnick at the US commerce department, who will take a special interest in this case due to his capital markets background.